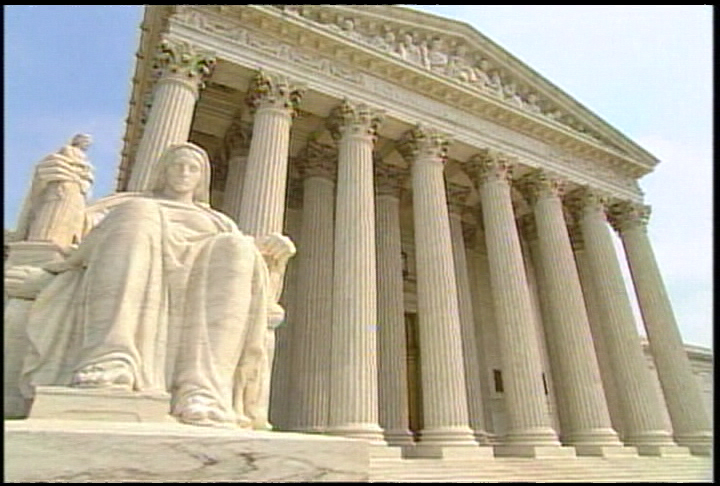

Supreme Court Outlaws the New Testament Church

UNITED STATES SUPREME COURT OUTLAWS THE NEW TESTAMENT CHURCH IN AMERICA, REFUSES TO HEAR BAPTIST TEMPLE CASE

January 16, 2001 no doubt will remain forever in the annals of church history as the day that religious liberty died in the United States of America. On that day the entire nine justices of the United States met to determine whether to hear the case of U.S. v. Indianapolis Baptist Temple. It was unanimous, they refused to hear it, which means that the decision of the three judge panel on the Seventh Circuit Court of Appeals in Chicago against the church will stand. Technically it is not the law of the land but only in the Seventh Circuit. However from a practical standpoint the U.S. Government is already using the Baptist Temple case against other churches through out the nation. One of the first instances is in a United States Motion To Compel which was filed in The U.S. District Court, Indianapolis Division on April 10. This action by the U.S. Government is to get Judge Sarah Evans Barker to compel Pastor Greg A. Dixon and Colleen Tiffany, church secretary to reveal the names and current phone numbers and addresses of those who serve in the financial ministry of the Baptist Temple.

On the same day the Justices refused to hear the Baptist Temple case they agreed to hear the case of a disabled golfer under the Disability Act who wants to ride a golf cart in the Professional Golf Association tournaments. This is certainly strange when you realize that the PGA didn’t even exist at the time the U.S. Constitution was ratified. Pastor Jim Grove from Carlisle, Pennsylvania said that the Supreme Court rode Almighty God out of Washington, D.C. on a golf cart. Also on that same day the Court heard a case where an illegal alien was suing the State of Alabama. It would be interesting to hear the Court explain how an illegal alien with no rights in the U.S. has precedent over the Lord’s church.

Following are excerpts of the Baptist Temple’s arguments before the highest court in the land as the Lord allowed us to be a witness for the Lord Jesus Christ. Our congregation counts it all joy that we have been chosen by divine grace, in the words of our blessed Savior the Lord Jesus Christ to be “…brought before rulers…for my sake, for a testimony against them” (Mark 13:9). Through this case we have been able to witness to the Lordship of Jesus Christ before the highest Jurists of the nation and untold thousands will read this testmony concerning the Lordship Of Jesus Christ.

Another point of interest: on the same day, Nov. 14 that Judge Sarah Evans Barker ordered the property of the church to be seized she also ruled that all monuments bearing the Ten Commandments be rooted up from all court house lawns in the State of Indiana. By the highest court in the land refusing to hear our case they have said in essence, not only are the Ten Commandments not allowed in public places but neither are they to be displayed in the house of the Lord.

A few minor changes have been made in the original brief for the purpose of clarity and brevity. The entire Writ Of Certiorari can be ordered through The Trumpet for a gift of $15. It also contains Judge Barkers ruling and the ruling of the Seventh Circuit Court of Appeal.

In The

Supreme Court of the United States

Indianapolis Baptist Temple, Petitioner,

v.

United States Of America, Respondent

On Petition For Writ Of Certiorari

To The United States Court Of Appeals

For The Seventh Circuit

Questions Presented For Review

Petitioner, Indianapolis Baptist Temple (IBT), is a New Testament Baptist Church founded solely by authority of the scriptures of the Holy Bible (1611 King James Version) and is in the succession of New Testament Churches (N.T.), from the time the N.T. Churches were founded by Jesus Christ as recorded by the scriptures of the Holy Bible to the present day. The church polity of the Baptist Temple is that of a special assembly of saved, baptized people as a visible body of Jesus Christ in Indianapolis, Indiana. The absolute sovereignty of the New Testament Church under the lordship of Jesus Christ as the sovereign head of the Church is the central tenant of the faith and practices of the Church. The Church polity does not permit IBT to organize or structure the church government as a not-for-profit organization (i.e., corporation, unincorporated association or a trust) or any other legal entity. IBT does not claim tax-exempt benefits under section 501(c)(3) as a tax-exempt religious organization.

The United States of America assessed employer taxes to IBT as an uincorporated association. IBT did not comply with the employer tax regulations because to do so would violate the central tenet of the faith of the church by recognizing a sovereign greater than Jesus Christ as an authority with power to regulate the polity and practices of IBT.

The lower courts made a distinction between the religious nature of the Church from the legal nature of the Church. The lower courts imputed to IBT a legal entity called an unincorporated association (i.e., religious society) as the legal nature of the church, which is contrary to the faith, practices, and polity of IBT.

Question 1. Does the application of the employer tax statutes and regulations to IBT which is a N.T. Church and not organized as a legal entity under State law and does not claim tax benefits as a tax-exempt religious organization or public charity under Sec. 501(c)(3) of the Internal Revenue Code, violate the free Exercise Clause or the Establishment Clause of the First Amendment of the U.S. Constitution when compliance with those statutes violates the faith and practices of the N.T. Church under the Lordship of Jesus Christ as the Head of His Church?

Question 2. Have the lower Courts established a State Church in violation of the Establishment Clause of the First Amendment by making a distinction between the religious nature of the Church and the legal nature of the Church, and imputing to IBT a legal entity as the legal nature for the Church when such a legal nature is contrary to the faith and practices and polity of the Church.

Question 3. Does the repudiation of the Church polity of IBT as a N.T. Church by the lower Courts and the imputation to the Church of a legal nature contrary to the faith and practice of the Church violate the Ninth Amendment of the U.S. Constitution?

Petition For Writ Of Certiorari

Petitioner, Indianapolis Baptist Temple, by its Pastor and Trustee, Gregory A. Dixon, respectfully prays that a Writ of Certiorari be issued from this Honorable Court to review the judgment and opinion of the United States Court of Appeals for the Seventh Circuit entered in this proceeding on August 14, 2000, in order to review an important question of federal law that has not been, but should be, settled by this Court, or that has been decided in a way that conflicts with relevant decisions of this Court.

Constitutional Provisions

This case involves the Free Exercise Clause and the Establishment Clause of the First Amendment of the U.S. Constitution and the Ninth Amendment of the Constitution.

The First Amendment provides in part: “Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof;”…The Ninth Amendment provides: “The enumeration in the Constitution, of certain rights, shall not be construed to deny or disparage others retained by the people.”

Statement Of The Case

The U.S. instituted this action under Sec. 7401 and 7403 of the Internal Revenue Code (Title 26) (IRC) by filing a complaint in the U.S. District Court, Indianapolis, Indiana, seeking to reduce federal employer tax assessments that the IRS had assessed against IBT as an unincorporated association for the tax years 1987-’93 to judgment and to forclose tax liens against real properties in possession of the Church.

In 1987, IBT was functioning as a “New Testament Church,” founded and organized under the sole authority of the scriptures of the Holy Bible. IBT was founded in Indianapolis, Indiana, in 1950 as a N.T. Church as the next in line of a succession of Baptist Churches that trace the lineage of the Baptist Churches by Jesus Christ during His earthly ministry through the Apostle John and an ancient N.T. Church founded by Polycarp, a disciple of the Apostle John in 150 A.D.

The Church polity of IBT is that “local, visible Church” model taught by the scriptures of the Holy Bible to be a special assembly of saved, baptized people called out and placed into the assembly by the Holy Spirit as a visible body of Jesus Christ in Indianapolis. The absolute sovereignty of the N.T. Church under the Lordship of Jesus Christ as the sovereign head of the Church is the central tenet of the faith and practices of IBT.

The Church polity does not permit the IBT to organize or structure the Church government as a not-for-profit organization (i.e., corporation, unincorporated association or a trust) or any other entity. As a N.T. Church, IBT existed as a separate and distinct body authenticated by the scriptures of the Holy Bible as the local, visible body of Jesus Christ, and did not claim tax-exempt benefits under Sec. 501(c)(3) as a tax-exempt religious organization or public charity in 1987 or at any time thereafter.

The IRS assessed employee taxes to IBT as an unincorporated association. An unincorporated association is a legal entity formed under State law and cannot be a N.T. Church founded under the scriptures of the Holy Bible. IBT did not pay the taxes assessed because IBT was not an unincorporated association and, as a N.T. Church could not be an unincorporated association. If IBT were to form an unincorporated association (or any other legal entity) for the government of the Church, or pay the tax, IBT would violate the central tenet of the faith of the Church by recognizing a sovereign greater than Jesus Christ as an authority with power to regulate the polity and practices of the Church.

The federal government conceded in this case, that IBT’s religious convictions were sincerely held and that the federal tax scheme conflicts with IBT’s religious doctrine.

The District Court denied IBT’s motion for summary judgment and granted the federal government’s motion for summary judgment on Nov. 12, 1999. The Seventh Circuit Court of Appeals affirmed the decisions of the District Court on August 14, 2000.

Both the District Court and the Court of Appeals rejected Constitutional protection for: (1) IBT as a N.T. Church; (2) the religious convictions of the Church concerning its polity as that of a “local, visible Church”…(3) its religious convictions and faith in the Holiness of the Lord Jesus Christ as the sovereign head of the Church. In doing so, the lower Courts distinguished between the legal nature of the Church and the religious nature of the church by imputing to IBT the legal entity of an unincorporated association as the legal nature of IBT.

In denying IBT’s motion for summary judgment, the District Court said: “IBT even suggests that it is neither a corporation nor an unincorporated religious society, Rather, it is a New Testament Church and nothing more. This position fails to recognize the legal nature of IBT, which the record established to be that of an unincorporated religious society.”

The Court of Appeals said: “…IBT takes issue with the District Court’s characterization of it as an unincorporated religious society under Indiana Law. IBT contends that it is a “New Testament Church,” and not an unincorporated religious society, and that by characterizing it as such an entity, the District Court “established” a state church and imposed on IBT a form of worship contrary to its beliefs. The District Court did neither of these things. It simply described the legal (not religious) nature of an already established church.”

Reasons For Granting The Writ

1. The Seventh Circuit’s opinion has decided an important question of federal law involving First Amendment protections of the Church, its polity, faith and practices from governmental regulation, interference and control that has not been, but should be, settled by the Supreme Court of the United States.

This case is not a tax case. It is a religious liberty issue that goes back to the foundationl purpose for which the Religious Liberty Clauses of the First Amendment were established. It involves the right of the N.T. Church to exist in America today.

The issue presented has never been presented to the Supreme Court before. There has never been a need for this Court to consider this issue before, because the federal government has never attempted to regulate the polity of a N.T. Church or its ministries before. By its opinion, the Seventh Circuit has in effect criminalized not only the faith and practices of IBT, but also the faith and practices of every N.T. Church in the U.S. The decision exposes all N.T. Churches in the U.S. to criminal and civil sanctions for the exercise of their faith in the Lordship of Jesus Christ as the sovereign head of His Church.

By targeting a N.T. Church, the government has actually targeted God. God is the issue. God is either the Head of His Church or He is not. The Seventh Circuit says He is not by distinguishing between the “legal nature” of the Church and the “religious nature of the Church.” By making this distinction, The Seventh Circuit has taken God out of the N.T. Church and put its members in a position where they, as a special assembly (i.e., Church), have to choose whether or not to violate the First Commandment of the Ten Commandments: “Thou shalt have none other gods before me.” (Deuteronomy 5:7).

There are only three primary models for Christian Churches that exist in the world today. Each model arose at different times in history, and each has its own polity, faith, and practices.

The first originated in the First Century, A.D. as recorded in the Holy Bible. The Church polity is that of a “N.T. Church” founded by the Lord Jesus Christ during His ministry on earth as the “local, visible body of Christ (i.e. Church).” This historic Baptist Churches adhere to this model.

The second model originated in Rome in A.D. 325 and was founded by the emperor Constantine when he formed a league with some of the N.T. Churches of that time and declared the Christian religion to be the religion of Rome. The Church polity of the Constantine Church was based upon the “universal, visible Church.” This model became the model for the Roman Catholic church in A.D. 610 when the Roman Emperor Phocus ordained Boniface as the first Pope and invested him with supreme ecclesiastical jurisdiction.

The third model had its origin at the Diet of Spires in A.D. 1529 with the origin of the Protestant Church and its many denominations. The Church polity of the Protestant Church is the “universal, invisible Church,” which makes a distinction between the “legal nature” of the spiritual Church.

The central tenet of the Baptist Churches adhering to the “local, visible Church” model is the absolute sovereignty of the Church under the Lordship of Jesus Christ as the Head of the Church. The doctrine of this Church requires the complete separation of the Church from the state. This doctrine of separation conflicts with the doctrine of both the Catholic Church and the many denominations of Protestant Churches which became established as State Churches.

The doctrine of the universal Church model is not offended by Church-State associations, and the Protestant Churches became State established Churches (i.e., Lutheran Church-Germany; Presbyterian-Scotland; Church of England-England). Throughout Church history, the State established Churches warred against the N.T. Churches who resisted their authority over the local, N.T. Churches, and persecuted them. The First Amendment purposed to end the persecution of the local N.T. Churches, called by the name “Baptist” and other “non-conformist Churches.”

The decision of the Seventh Circuit puts the N.T. Churches back to the place they were in before the First Amendment was adopted. Today, IBT is being punished for adhering to the faith and practices of the N.T. Church as a “local, visible body of Christ” by the loss of the Church properties and criminal and civil sanctions.

Further, the decision establishes the “universal Church” model whose doctrine is not offended by State-Church alliances as a State Church in the U.S. to the exclusion of the practice of the faith and practice of those Churches adhering to the N.T. “local, visible body of Christ” model.

The Supreme Court has reviewed the effect of government regulations, tax laws, etc. on the religious beliefs of:

(1) Individuals: See, U.S. v Lee, [455 US 252 (1982)] where an Amish businessman was required to withhold Social Security taxes from his employees; etc.

(2) Christian Churches and Christian Ministries modeled upon the “universal, invisible Church” model as tax-exempt religious institutions: See, Bob Jones University v U.S., [461 U.S. 574 (1983)] where the Court held that the tax-exempt gift to a tax-exempt nonprofit corporation was a public subsidy and all laws and public policies are binding upon it; Swaggart Ministries v Cal. Bd. of Equalization, [493 US 378 (1990)] where a tax-exempt non-profit corporation was required to pay state sales tax, etc. Ed note: Cases involving The Mormon Church as an Unincorporated Association, and a Catholic Church was also cited under this heading.

(3) Non-Christian faiths organized as tax-exempt religious institutions: See, Church of the Lukumi Babalu Aye, Inc. v City of Hialeah, [508 US 520, 546-47 (1993) where the Supreme Court upheld the sacrifice of chickens as a religious animal sacrifice is protected by the First amendment for the Santeria religion which is organized as a tax-exempt non-profit corporation.

But this Court has never considered the effect of government regulations on the faith and practices of the N.T. Church which is a special assembly of saved, baptized people existing as the body of Christ on earth as the Lord’s “ecclesia” (assembly) ( Matt. 16:18).

All the facts in these cases can be distinguished from the facts present in IBT. The Seventh Circuit refused to distinguish these facts from the facts of IBT and relied upon Smith. The Seventh Circuit said, “Significantly, however, neutral laws of general application that burden relgious practices do not run afoul of the Free Exercise Clause.”

Although the tax laws appear to be neutral on their face, it cannot be argued that the tax laws are “neutral in their effect” when applied to the doctrine, faith, and practices of the N.T. Church. This is an issue that was not present in Smith that this Court has not yet ruled upon.

Only this Court can settle this issue, the issue of God as the sovereign head of His Church in the U.S. Can the government tax God? Can the government regulate God? If the decision of the Seventh Circuit stands, the answer is yes, and the decisions of this Court and the Seventh Circuit have rendered the protections of the Religious Liberty Clauses of the First Amendment of the U.S. Constitution for the New Testament Churches of non-effect.

11. The Seventh Circuit’s opinion has decided an important federal question in a way that conflicts with relevant decisions of this court.

The Seventh Circuit opinion conflicts with the holding of this Court in Murdock v. Pennsylvania, [319 U.S. 105 (1943)]. In Murdock, this Court struck down a flat license tax imposed on religious activities because the tax was levied and collected as a prior restraint to the exercise of religion. The Court said, “The constitutional rights of those spreading their religious beliefs through the spoken and printed word are not to be gauged by standards governing retailers or wholesalers of books.”

Citing Magnano Co. v. Hamilton, [292 U.S. 40, 44 (1934)], the Court said, “The power to tax the exercise of a privilege is the power to control or suppress its enjoyment.”

The facts in the IBT case are not unlike those in Murdock. The imposition of the employer tax laws to a N.T. Church existing solely under the authority of the scriptures of the Holy Bible as a special assembly of saved, baptized people as a sovereign body under the Lordship of Jesus Christ operates as a prior restraint on the exercise of their religion. The assembly cannot exist unless it first denies its faith in the Holiness of the Lord Jesus Christ and recognizes the government as the head of the Church instead of Christ. In accordance with this Court’s holding in Murdock, the N.T. Church and its polity, faith and practices cannot be gauged by standards governing individuals, businesses, tax-exempt public charities or tax-exempt religious organizations whose religious convictions, church polity, faith and practices are not offended by church-state entanglements. The power to tax the N.T. Church in effect controls and suppresses the exercise of the faith and practices of the Church.

The Seventh Circuit opinion also conflicts with the holding of this Court in Rector, Etc., of Holy Trinity Church v. U.S., [143 U.S. 457 (1892)]. The Holy Trinity Church was a case where the government first attempted to regulate the church by enforcing the “Alien Laws” to the church. The government attempted to deport a Bishop the Church had brought over from Europe. This Court rebuffed the government’s attempt. After reviewing and considering the foundational and fundamental laws and customs upon which this nation was founded, this Court said, “The language of the act, if construed literally, evidently leads to an absurd result. If a literal construction of the words of a statute be absurd, the act must be so construed as to avoid the absurdity.”

Citing, U.S. v. Kirby, [7 Wall. 482 (1868)], this Court said, “All laws should receive a sensible construction. General terms should be so limited in their application as not to lead to injustice, oppression or an absurd consequence. It will always, therefore, be presumed that the legislature intended exceptions to its language which would avoid results of this character.”

Then this Court asked, “In the face of all these, shall it be believed that a congress of the U.S. intended to make it a misdemeanor for a Church of this country to contract for the services of a Christian minister residing in another nation?

Then the Court held that the statute was not applicable to the Church of Holy Trinity and said, “It is the duty of the courts, under those circumstances to say that, however broad the language of the statute may be, although within the letter, is not within the intention of the legislature, and therefore cannot be within the statute.” [ Holy Trinity v. U.S.]

The imposition of the employer tax laws to IBT has lead to the prosecution of the Church; the seizure and imminent sale of its properties; the exposure of all N.T. Churches in the U.S. to criminal and civil sanctions for exercising their faith in the Lordship of Jesus Christ as the Holy, Sovereign Head of the Church in all things; and the ultimate extinction of the N.T. Churches in the U.S. These results are absurb in light of the history of the Religious Liberty Clauses of the First Amendment.

Congress simply did not intend the employer tax laws to apply to a N.T. Church that has not organized itself as a public charity seeking benefits as a tax-exempt organization under Sec. 501(c)(3) of the Internal Revenue Code.

CONCLUSION

The Petition for Writ of Certiorari should be granted.